Tactical Risk Solutions (TRS), AccuRisk’s VT-based captive program for medical stop loss and other alternative risk finance programs combines our underwriters’ best instincts with a strong analytical mindset to provide an alternative risk for AccuRisk’s customers and prospects. TRS, shares our overall vision: building strong partnerships that always stay ahead of the curve with creative and inventive ideas, unique customization, and excellent execution.

Interested in a Captive solution? Try an RBP Captive!

AccuRisk works with the leading Reference-Based Pricing vendors to offer the industry's most competitive plan designs. As an RBP specialist, we are the preferred underwriter for several vendors because of our ability to get lower overall claim costs. We've earned their trust through our experience and expertise in administering RBP claims. Plus, we're able to offer a wider selection of providers than a traditional PPO Network.

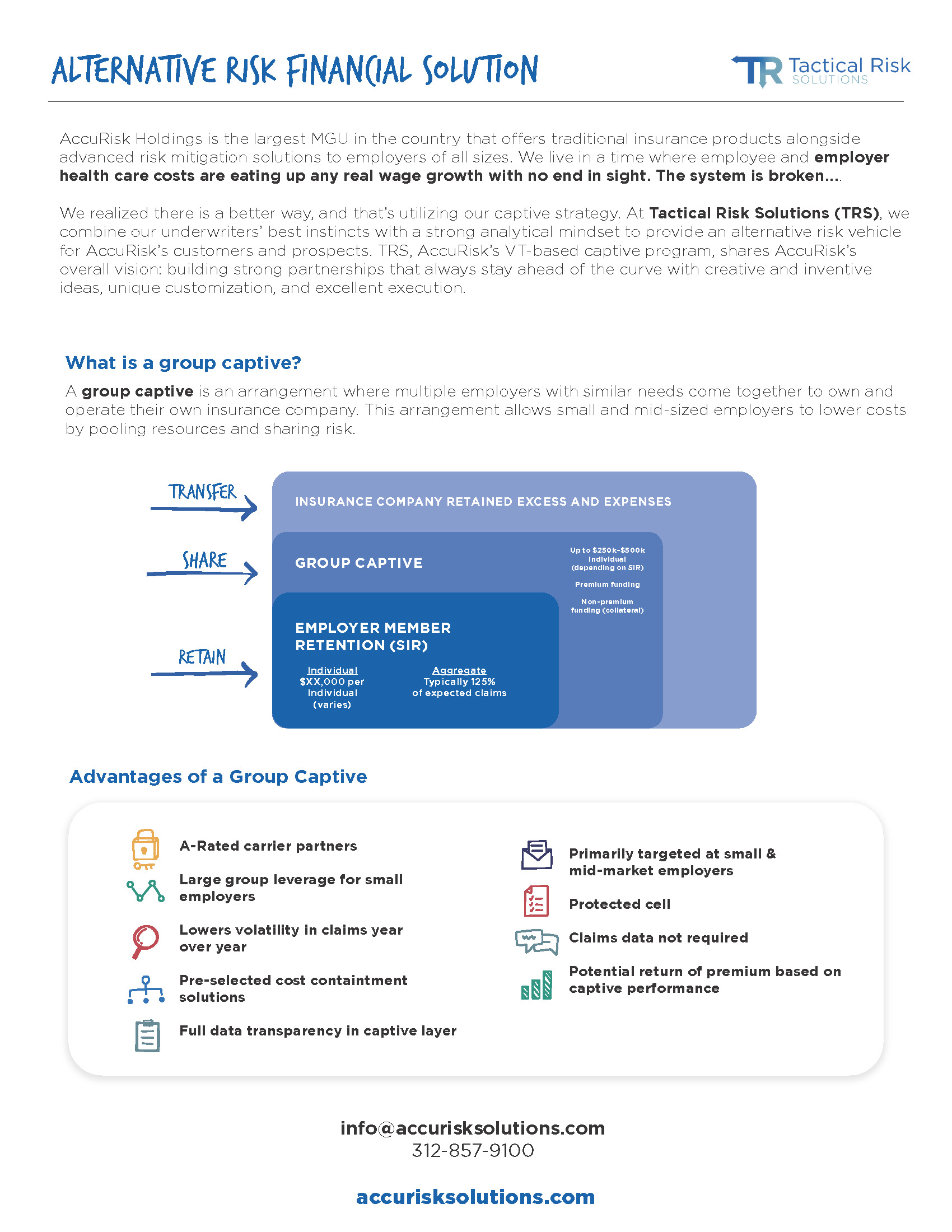

GROUP CAPTIVE

A group captive is an arrangement where multiple employers with similar needs come together to own and operate their own insurance company. This arrangement allows small and mid-sized employers to lower costs by pooling resources and sharing risk.

AGENCY CAPTIVE

An agency captive provides its own strategic advantage against competitors. Utilizing an agency captive allows for the reinsurance structure to use a protected cell rented by the owner in conjunction with a licensed captive like Tactical Risk Solutions.

Pricing transparency

Pricing transparency

Coverage and incentive customization

Coverage and incentive customization Potential for savings and profit-sharing

Potential for savings and profit-sharing Long-term cost stability

Long-term cost stability